Lessons I Learned From Info About How To Build An Amortization Schedule

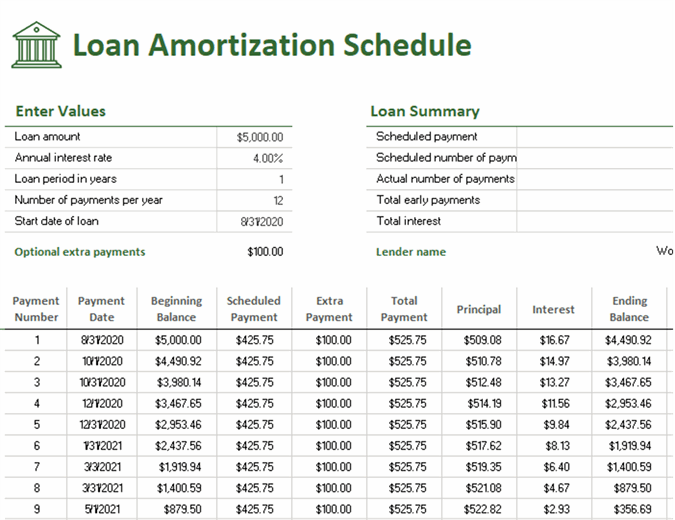

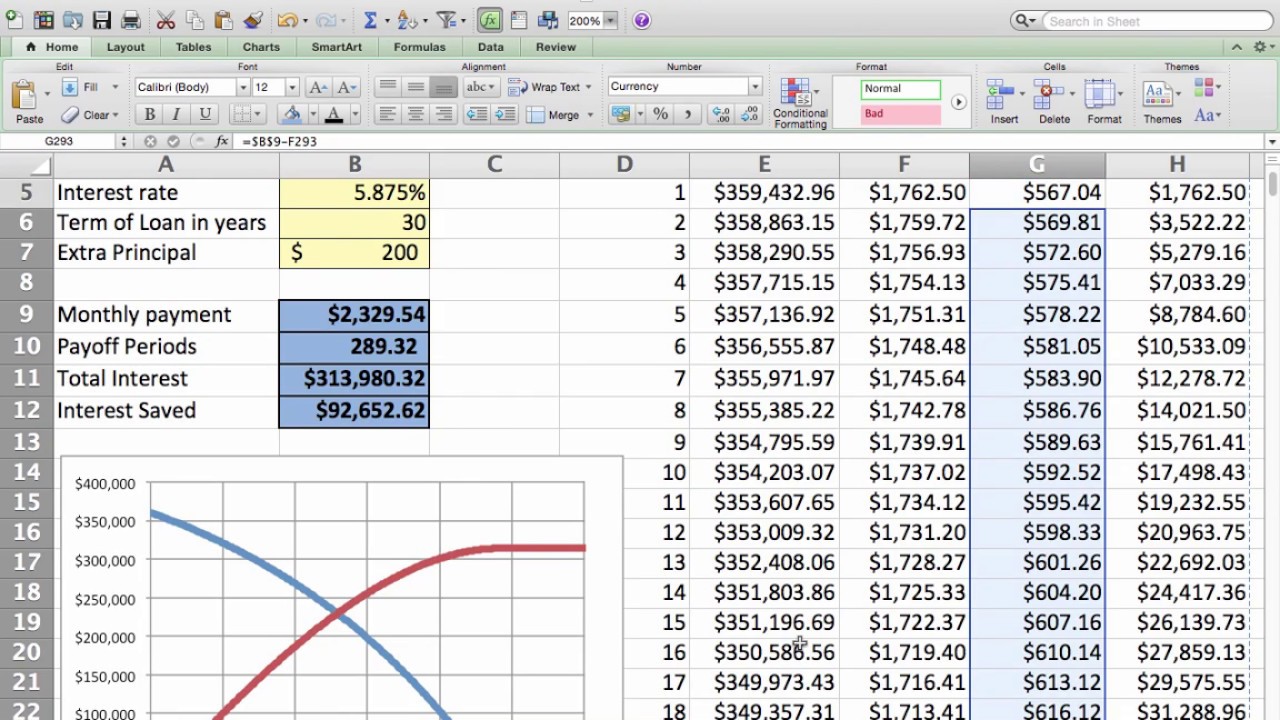

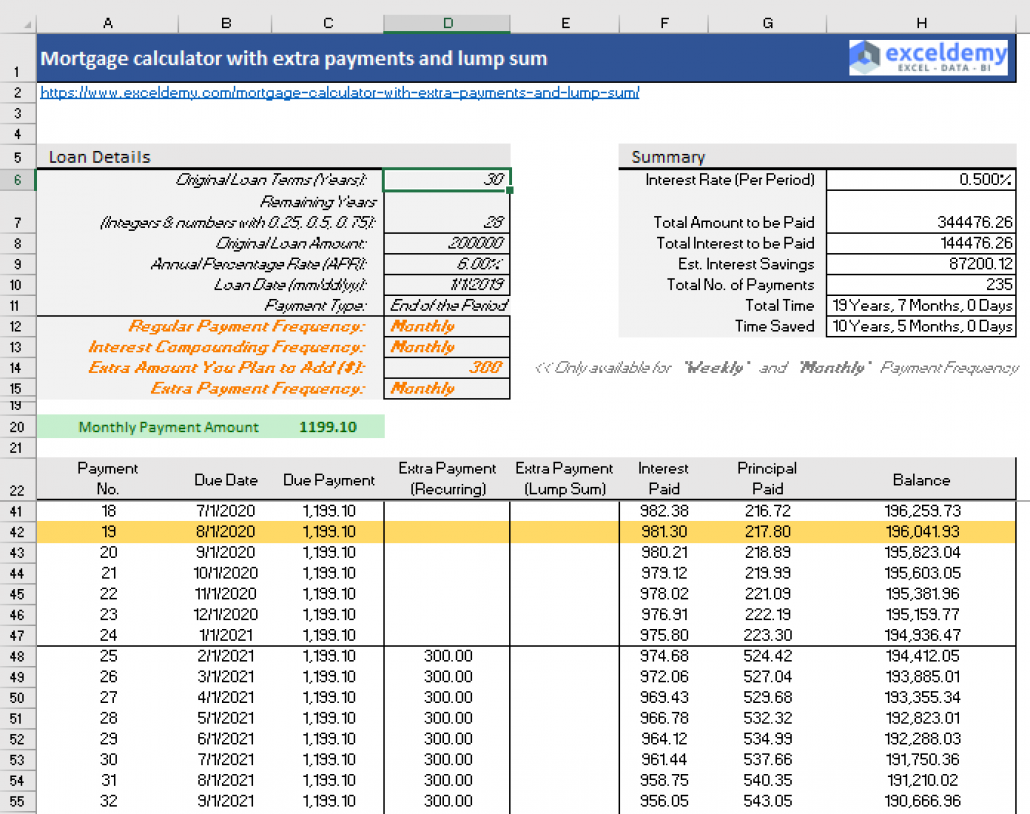

And the additional amount paid.

How to build an amortization schedule. For the first payment, we already know the total amount is $1,342.05. The answer depends on : Ad need a business loan?

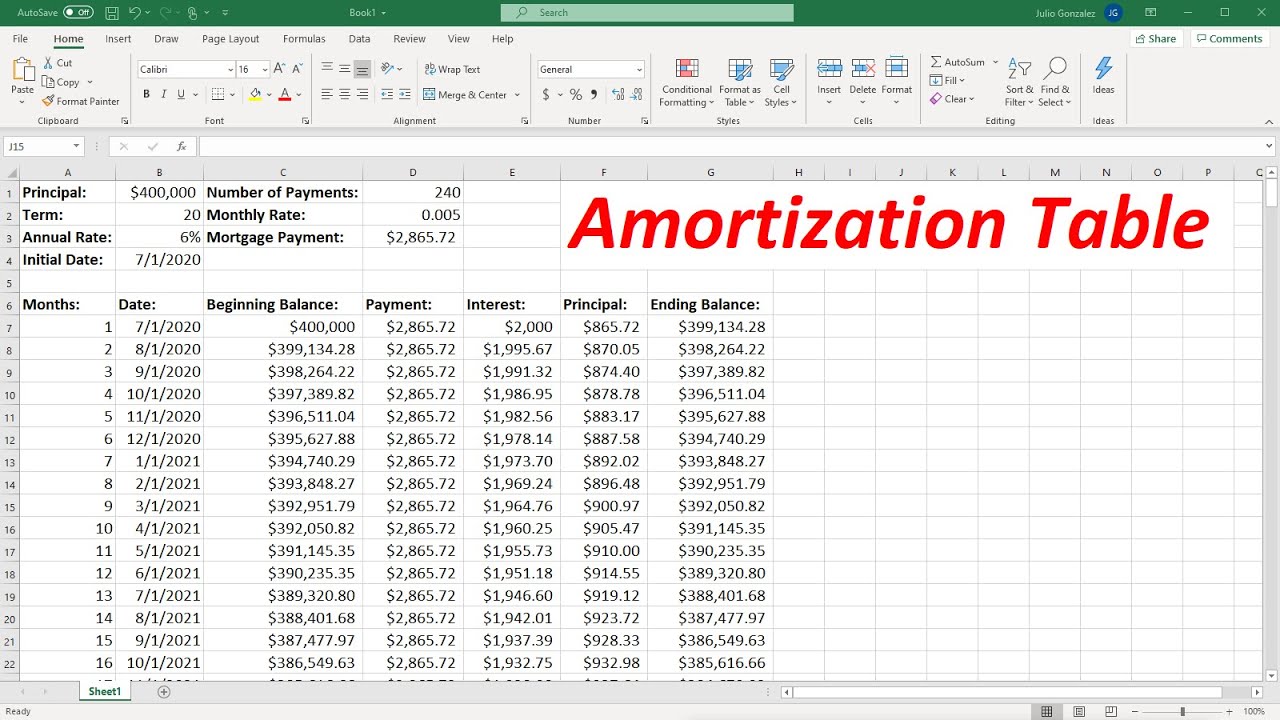

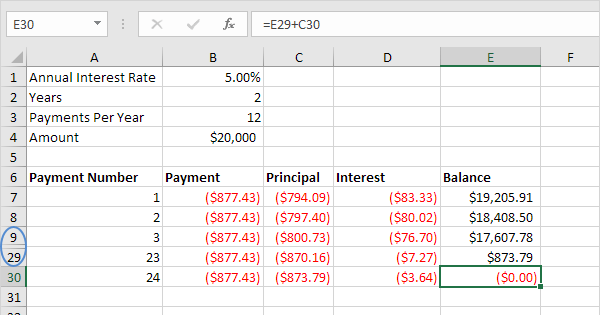

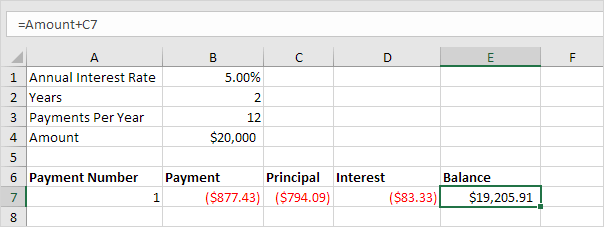

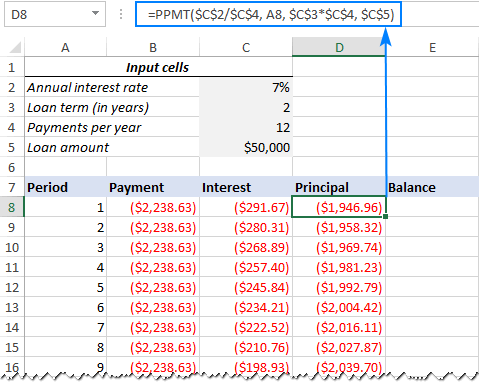

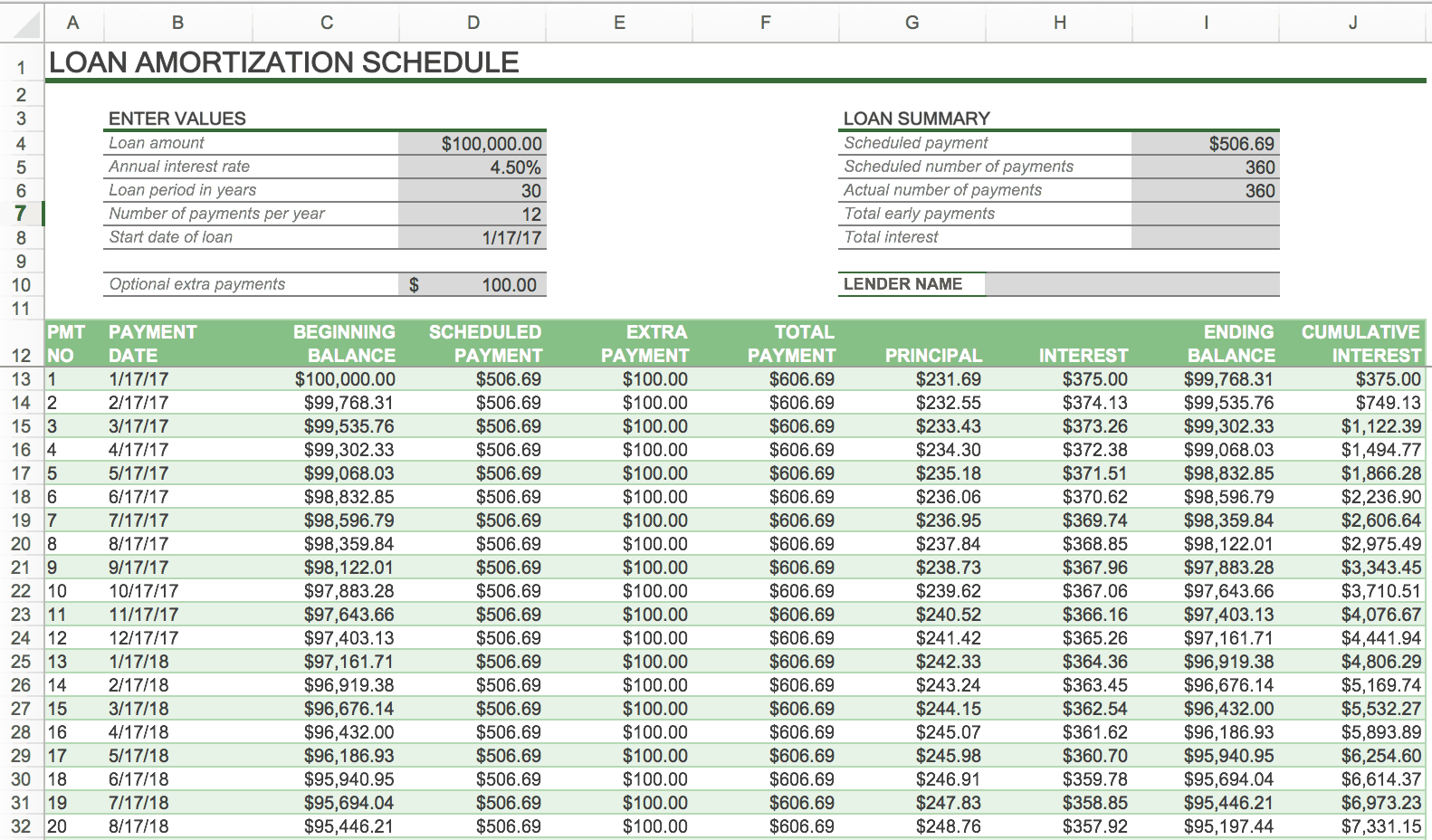

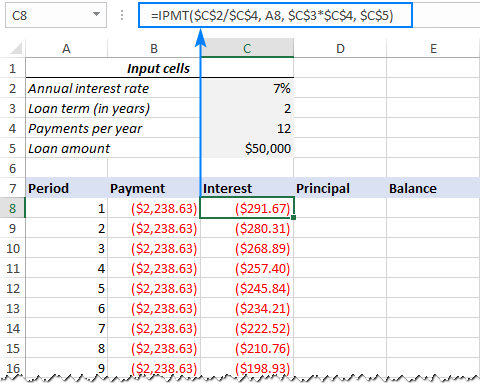

How to create an amortization schedule in excel. Now that we have the summary table, the next step is to build out the amortization schedule. After the amortization feature has been set up, amortization schedules are generated for purchase transactions containing items or expense lines that have.

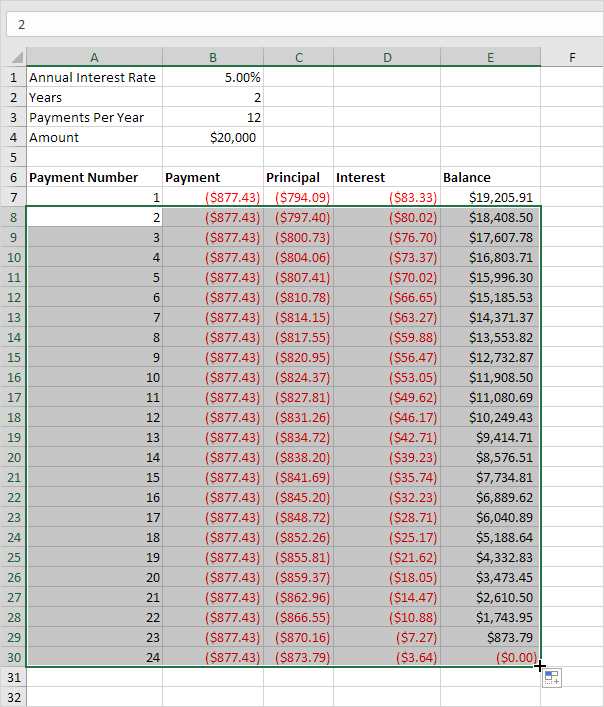

On the period column, enter the month and the year of the first loan payment in the first cell, then drag down from the selected cell to populate the entire column. To determine how much of that goes toward interest, we multiply the remaining balance ($250,000) by the monthly. Enter your basic information in the loan terms section.

Amortization schedule (this will serve as a title for. ##### parameters ##### # convert mortgage amount to negative because money is going out. The balance of the loan.

Here are eight steps to help you create an amortization schedule within the excel software application: In this video, we build a simple amortization schedule that you could use for a number of applications such as mortgages, student loans, or car loans. This amortization schedule will let you know what.