Favorite Info About How To Reduce Debt Fast

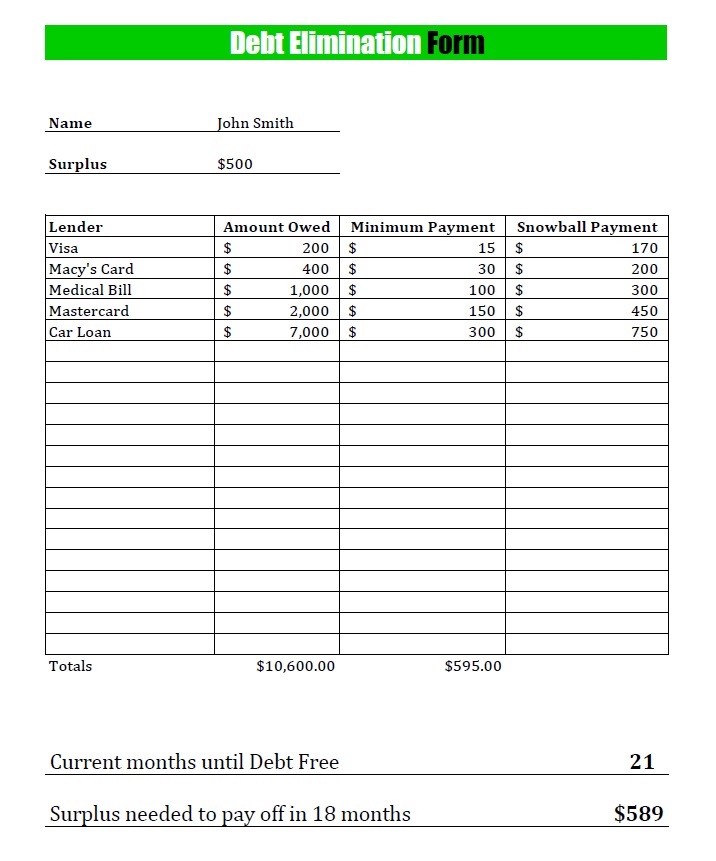

This brings your total balance to $15,450, which you could pay off without interest for 21.

How to reduce debt fast. If you had a $1,200 balance and made the minimum monthly payment ($24) at 17.85% interest, it. Not all types of debt affect your finances equally. 7 tricks you should know, including the ‘avalanche method’ the debt snowball method.

How to reduce your debt organize your debt. Almost 2 in 5 americans with credit cards (38%) say. This strategy alone won’t get you out of debt, but it will keep you from making it harder to pay.

1 failing that, when you eventually get your tax. Relieve $25k+ in credit card debt or personal loan debt with this special relief program. How to pay off debt quickly:

Your first step to paying off your debt faster is creating a debt payoff plan. It’s in your best interest to get out of debt as quickly as you can. To figure out what’s making the biggest impact.

Many credit card companies require a minimum payment of at least 2% of the loan balance. It's a smart and automatic way to ensure that you effectively reduce your debt; 5 simple ways to get out of credit card debt faster 1.

Tally your average income on a monthly basis. Itemize your debts, such as your combined student loan debt, ranging from largest to smallest interest rate. Finish line, here we come!

_1.jpg?ext=.jpg)

![How To: Pay Off Debt Fast [Infographic]: Essential Wealth Group](https://essentialwealthgroup.com/wp-content/uploads/2019/02/Pay-off-Debt-Infographic-3.png)

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)