Build A Tips About How To Choose Retirement Plan

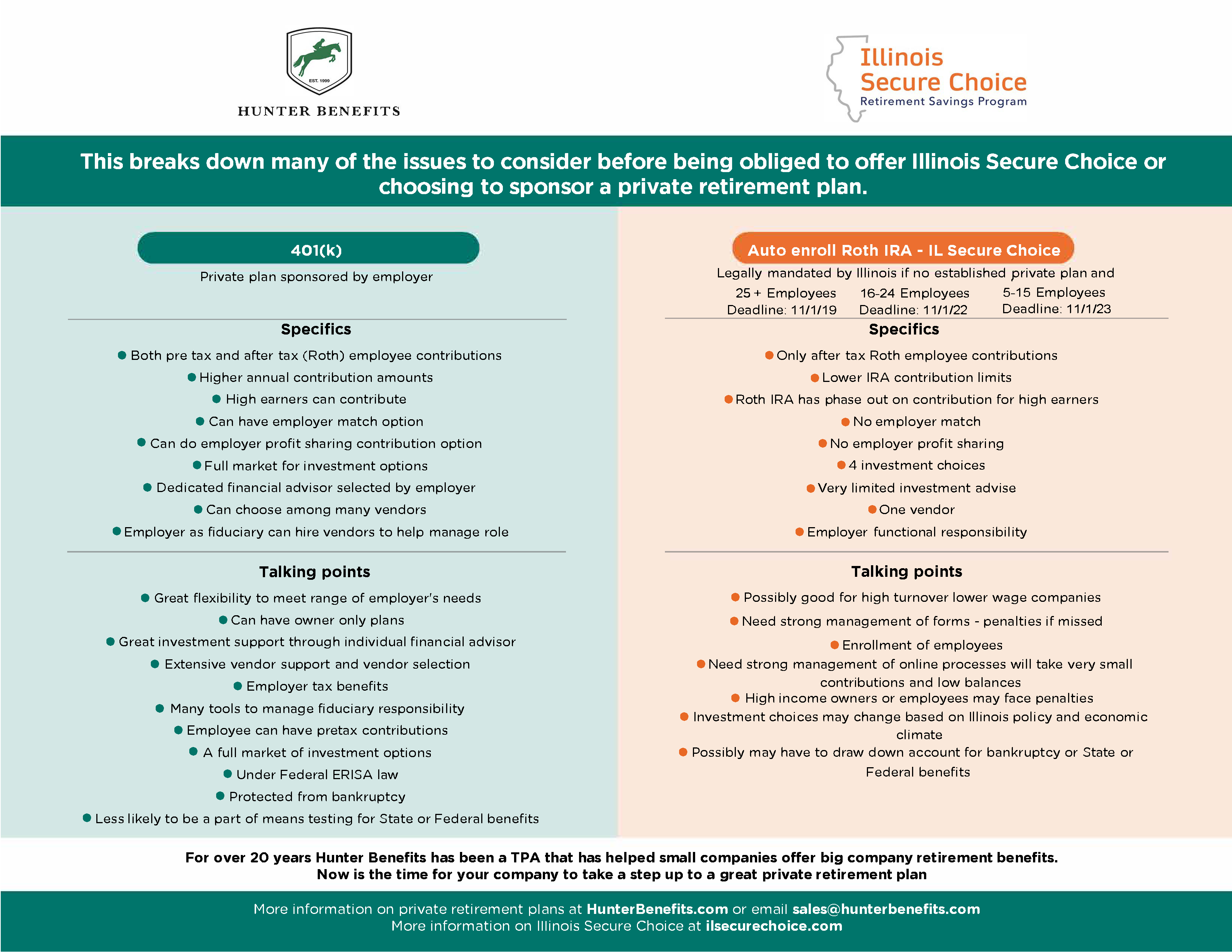

The size of a business plays a direct role in what retirement plans are.

How to choose retirement plan. Terms to know when doing retirement planning. After three years of service, 100 percent of honeywell’s matching. A subset of the 401 (k) plan is the simple 401 (k) plan.

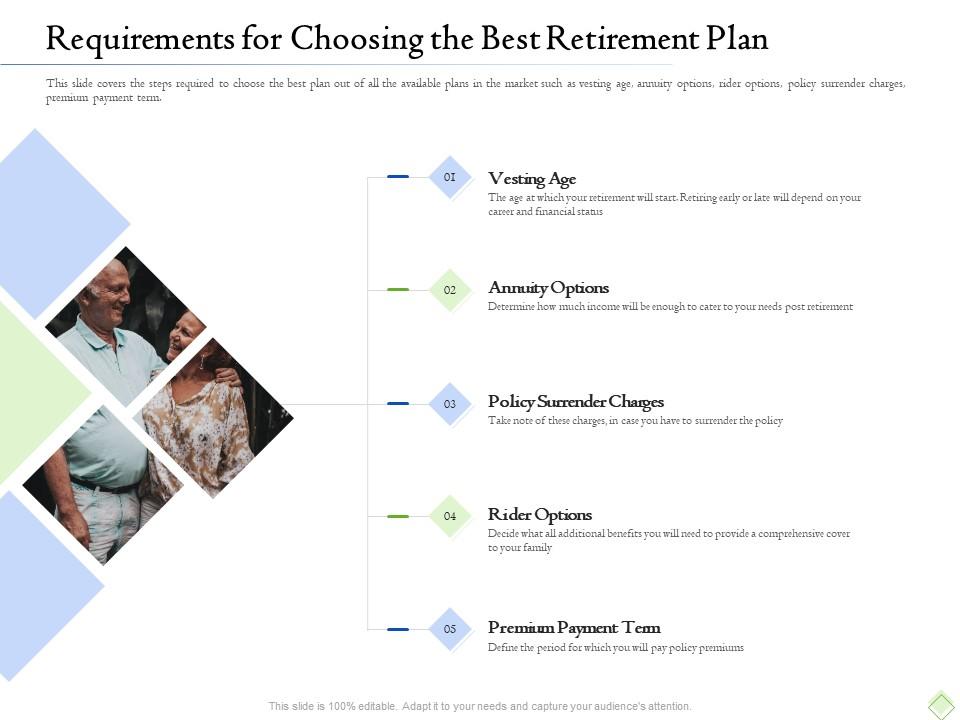

Can be a business of any size. Consider the size of your company. Start by thinking about your intentions, rather than different types of retirement plans.

Learn how to pick the best plan for you and your family, and start saving for your retirement now! The larger the survivor’s benefits, the smaller your monthly. He then recommends putting money in a.

A new approach to financial. Benefits to starting a plan. People who retire comfortably avoid these financial advisor mistakes.

Ad avoid these 7 retirement mistakes at all costs. Setting up a 401(k) plan. The most common options allow you to select either 50, 75, or 100 percent of your benefit payment for the survivor.

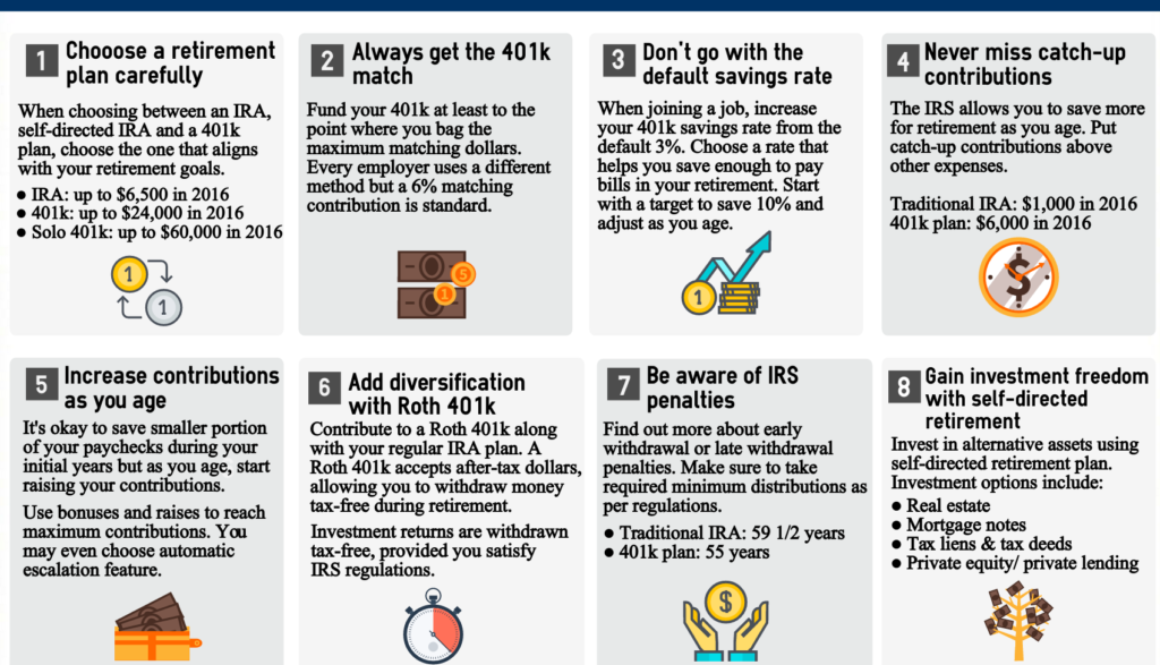

First, contribute up to the employer’s match for the 401 (k). Defined benefit:monthly retired pay for life after at least 20 years of service. Plan 3 offers a few options for graduated rates that can increase your retirement.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)